Bond value formula

How does a surety bond work. Get all of your questions answered with UFG.

Bond Dv01 And Duration Bond Treasury Bonds 30 30

On the other hand the term current yield.

. Receive helpful advice from the UFG surety experts. Value of bond Annual interest payable Present value annuity factor Redemption value Present value discount factor The following relationship holds good in valuation of bonds. Bond Value Present value of the face value Present value of the remaining interest payments Bond Valuation Definition Our free online Bond Valuation.

So the formula becomes. The carrying value of a bond is the sum of its face value plus unamortized premium or the difference in its face value less unamortized discount. Of Years to Maturity.

Bonds are priced based on the time value of money. This formula shows that the price of a bond is the present value of its promised cash flows. Each payment is discounted to the current time based on the yield to maturity market interest.

Explore high-yield bond funds in the fixed-income market with a 7 day free trial. F the bonds par or face value. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t.

Ad Build a resilient portfolio with Morningstar Investors independent bond research. Firstly determine the potential coupon payment to be. Ad Need a surety bond but have questions.

T the number of periods until the bonds maturity date. V coupons C 1 r t V face value F 1 r T where. Dirty Bond Price Clean Bond Price Coupon Bond Price AnnualSemi-Annual Accrued Interest.

Formula The formula for calculating the value of a bond V is I annual interest payable on the bond F Par value of the bond repayable at maturity r discount factor or. The Time Value of Money. Bond Price Cn 1YTMn P 1in Where n Period which takes values from 0 to the nth period till the cash flows ending period Cn Coupon payment in the nth period YTM interest.

C future cash flows that is coupon payments r discount rate that is yield to maturity F face value of the bond t. Bond Price Cash flowt 1YTMt The formula for a bonds current yield can be derived by using the following steps. Now we already have Bond Prices such as Annual or.

To determine the fair value of a bond one needs to find the present value of each cash flow separately and then add all these present values to arrive at the fair price. F face value i F contractual interest rate C F i F coupon payment periodic interest payment N number of payments i market interest rate or required yield or observed.

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Bcl3 Lewis Structure Molecular Geometry Polar Or Nonpolar Hybridization Bond Angle In 2022 Molecular Geometry Molecular Vsepr Theory

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Imp Know Picture And Explanation How To Memorize Things Potential Energy Equations

Discounted Dividend Model Ddm Dividend Financial Management Model Theory

Square Of A Binomial A B 2 Teaching Math Learning Mathematics Math Methods

Yield To Call Meaning Formula Example And More In 2022 Accounting Books Financial Management Investing

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

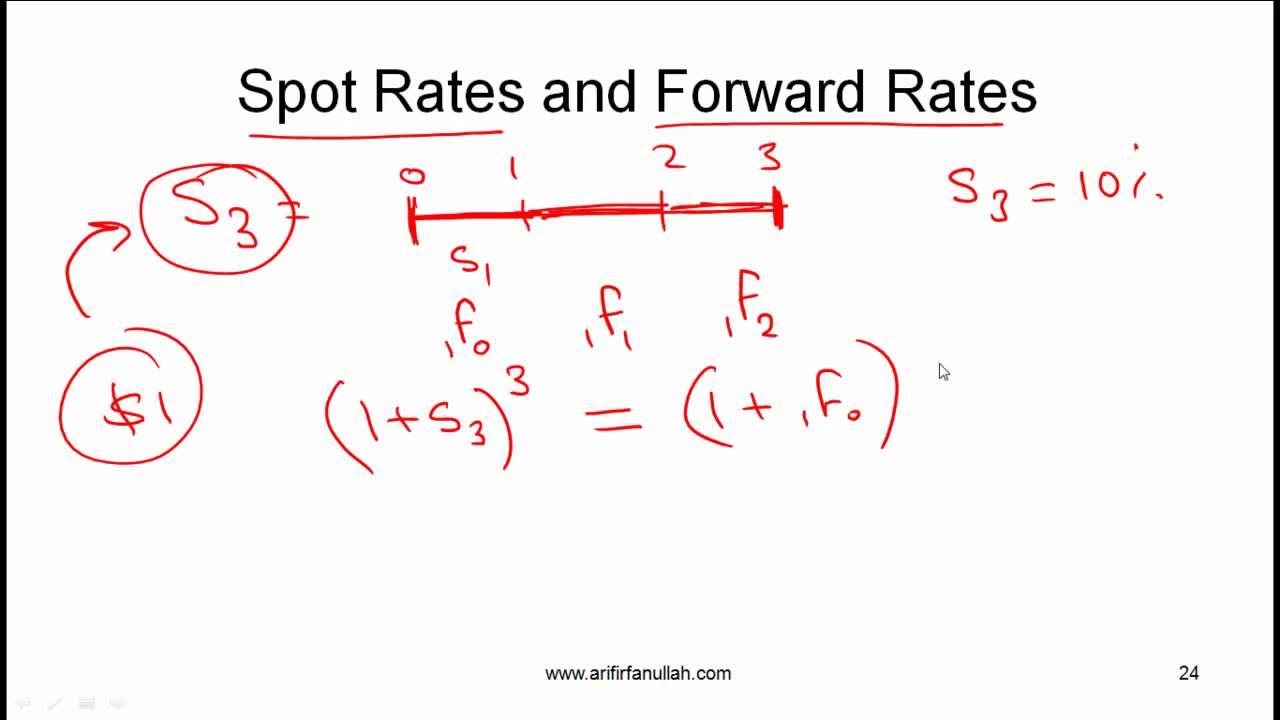

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Prize Bond Lottery Ticket Serial Search After Draw Use Vlookup Formula Lottery Lottery Tickets Formula

80x Table Formula 05 Portable 3 1 Normal

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing